29+ Calculating Customs Bond Amount

Add any additional costs. Multiply the total by 25.

Calculating Customs Bond Amounts Usa Customs Clearance

Web A Single Entry Bond means just that.

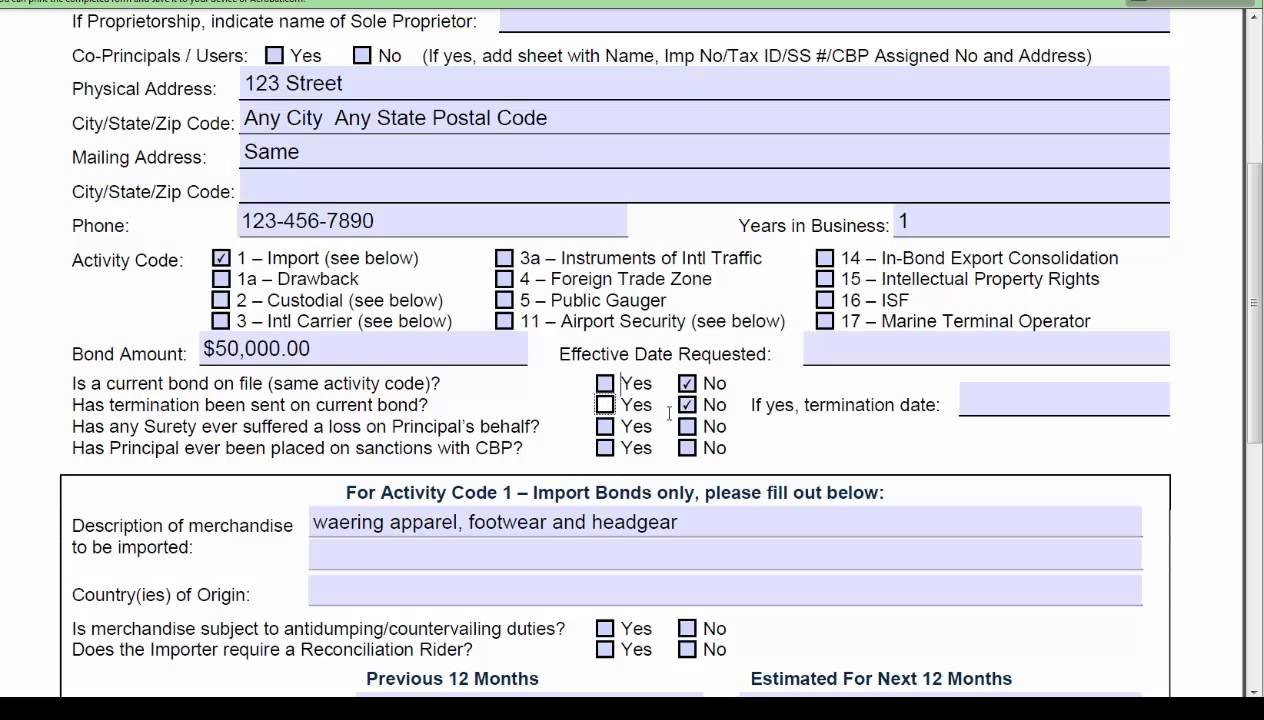

. Web Duties Taxes Fees x 10 minimum bond amount or 50000 rounded up or down by increments previous calendar year of 10000 up to 100000 and then by increments of. A single entry bond is generally in an amount not less than the total entered value plus any duties taxes and fees. Web Your guarantee amount must be sufficient to cover the full value of all duties and taxes that may be due for all goods in customs processes at any one time.

Web None to 1000000 duties and taxes - the bond limit of liability amount shall be fixed in multiples of 10000 nearest to 10 percent of duties taxes and fees paid by the importer. Web Current bond formulas can be found on wwwCBPgov. A one-time entry of a shipment through a designated US port.

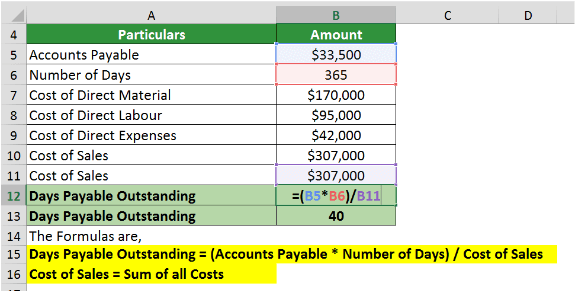

Web 12 months of fees paid on import transactions The calculation for a Continuous Bond amount is the estimated total duties taxes and fees for the previous or next 12 months. Web Calculate a value for duty using the appropriate duty method. Rather than being based on the total value of the goods a continuous bond is based on the total duties.

Web 3510-004 Monetary Guidelines for Setting Bond Amounts US. Web When posting a continuous D120 Customs bond the bond size must be 50 or more of the highest monthly accounts payable to the CBSA within the most recent. Once a single entry bond has been acquired the goods have to.

Customs and Border Protection Home Directives 3510-004 Monetary Guidelines for Setting Bond. Continuous Customs Bond amounts are calculated based on 10 of the. Web You can apply to reduce the amount your guarantor needs to provide to 50 or 30 of the potential debt covered by your customs comprehensive guarantee.

By applying the 20 rate to the value it. Web The general rule for calculating a Customs bond amount is 10 of the amount of duties taxes and fees paid by the importer of record in the previous twelve. Roanoke Trade is pleased to introduce our Bond Sufficiency Calculator a new tool to help you determine the appropriate.

Web Once your annual duties taxes and fees meet or exceed 500K you must purchase a larger bond amount. Web Continuous Customs bonds are calculated differently. Web Introducing the Bond Sufficiency Calculator.

Web Customs import bonds are a specific type of surety bond a contractual obligation made between three separate parties to guarantee payment of import duties and taxes. Web Customs bonds are broken down into activity codes that are designed to cover specific situations and import trade and travel activities. Below is a detailed description of the.

What Is A Customs Bond A Comprehensive Guide In 2023

Calculating Customs Bond Amounts Usa Customs Clearance

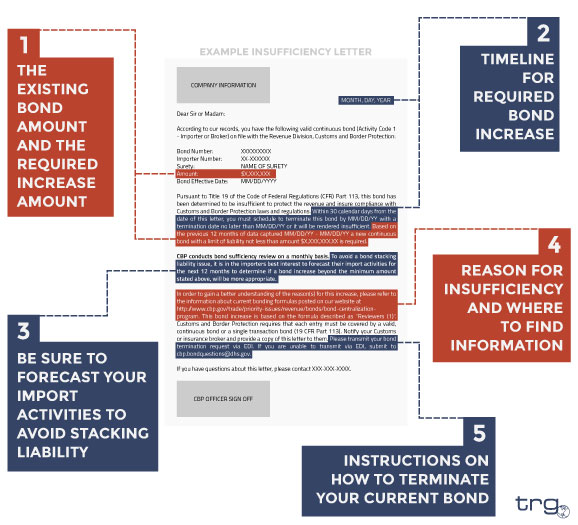

Understanding Insufficient Customs Bonds In 9 Easy Steps

What Is A Customs Bond A Comprehensive Guide In 2023

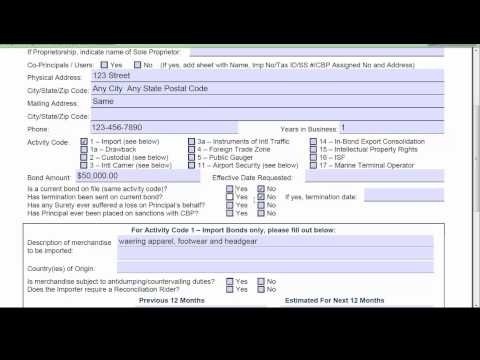

How To Calculate Your Customs Bond Size Youtube

Calculate Your Customs Bond Size U S Customs Bonds

Customs Bonds And Its Relevance Explained More Than Shipping

8 Real Estate Commission Calculator Templates Templates Business Names

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

How To Complete A Customs Bond Application Youtube

Customs Bond Types Customs Bonds Import Bonds Bonds4customs

Days Payable Outstanding Dpo Excel Template Educba

Understanding An Insufficiency Letter Customs Bond Sufficiency

Discontents At Rome San Francisco Bay Area Independent Media

8 Real Estate Commission Calculator Templates Templates Business Names

Calculate Your Customs Bond Size U S Customs Bonds

Customs Bonds What Is A U S Customs Bond Trade Risk Guaranty